We will explore any territory in pursuit of an idea, taking unconventional approaches and making big, bold investments in unexpected places.

Capturing Market

Opportunities

Our thinking reveals possibilities unimagined by others. Together, we move swiftly to capture opportunities in the markets.

Our Approach

Drive capital to the world’s most impactful and compelling investments, leveraging our combination of talent, technology, analytics and global scale.

Only at Citadel:

Ideas in Action

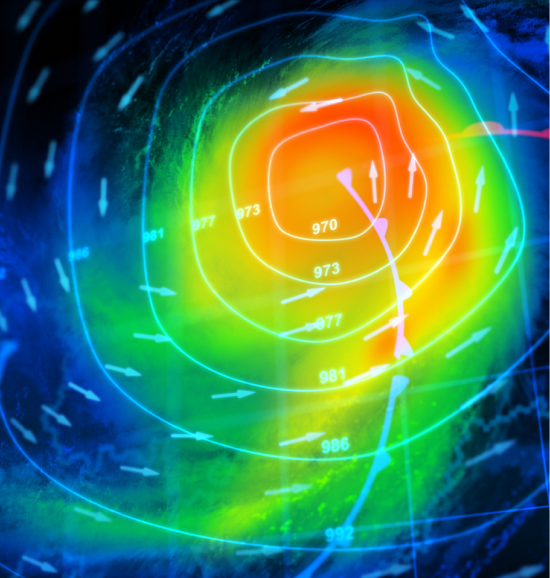

Taking Weather Prediction to a New Level

From agricultural products to natural gas, changes in the weather play a key role in determining the prices of commodities. We asked: What if we could forecast those changes better than anyone else?

Over the past five years, our Commodities strategy has assembled a team of PhD-level atmospheric scientists who understand and can predict signals generated from weather phenomena, from windstorms that last two days to El Nino events that last a season. Working in tandem with a team of High-Performance Computing specialists, they’ve built a differentiated applied research operation.

Today, they help transform terabytes of data a day into actionable forecasts, communicating weather-driven commercial opportunities and risks to our investment teams. Their tools and proprietary weather models provide answers to research queries in a fast, flexible manner. Weather analytics are now embedded in investment decisions, representing a unique depth of capability.

Five Strategies.

One Commitment.

Across all major asset classes and geographies, we have a singular focus: delivering industry-leading returns.

Our Competitive

Advantage

Extraordinary

People

Talent from across finance, science, technology and other fields gather here.

Our firm is a place for extraordinary growth. Our people benefit from our unparalleled resources and learn from the talent assembled around them.

This combination of talent, collaboration and inspiration empowers our people to work at the peak of their potential.

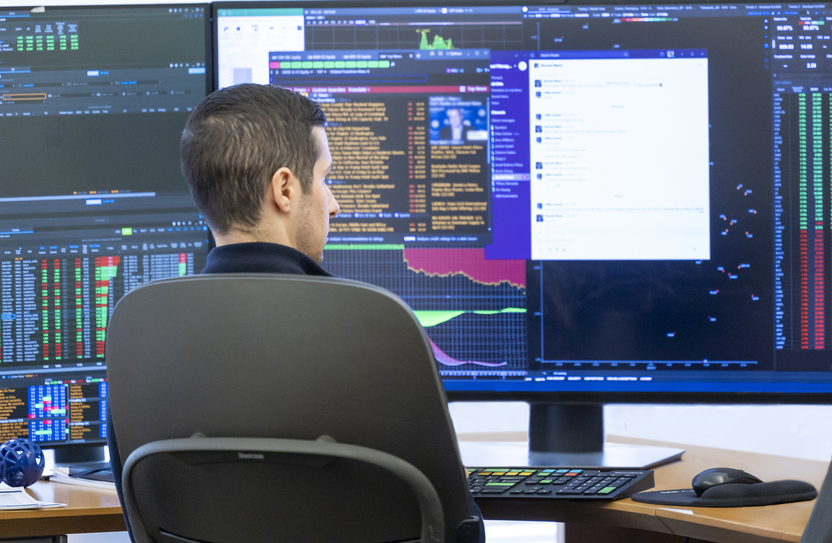

Superior Analytics and Technology

Technology is the lifeblood of our firm. Our ambitious thinking frequently requires innovations that don’t yet exist—so it’s up to us to build them.

Our engineering and quantitative research teams drive us forward with proprietary technology and tools, models and algorithms created in partnership with the investment teams. Their ingenuity solves entirely new problems in often surprising ways. And as technology evolves, so do we.

Disciplined Risk Management1

Risk managers are specialists in the asset classes they cover, enabling more productive dialogue with investment professionals.

The Portfolio Construction and Risk Group operates independently of our investment team and reports directly to the CEO. The Group identifies key risk exposures and performance drivers, monitors risk tolerance levels, fosters a strong risk management culture and refines the technology platform that provides the firm with robust analysis.

From our Risk Management Center, the firm’s positions experience constant monitoring, review and automated testing—with investment professionals using constantly updated stress-testing scenarios.

Recognized for Excellence

In an industry where the drive to prove yourself never ends, we are consistently recognized for our achievements.